Ever wondered what lies behind the term “variable-rate mortgage”?

It sounds pretty complex.

We will break it down and make sense of it all today.

As its name implies, a variable-rate mortgage is a home loan with an interest rate that fluctuates over time.

On the other hand, a fixed-rate mortgage maintains the same rate throughout the loan period.

This can be either to your advantage or disadvantage depending on market conditions.

Exciting and a bit nerve-wracking, isn’t it?

Understanding these mortgages is not just for financial experts or real estate tycoons. It’s crucial for you too. Why, you may ask?

If you’re buying a house, refinancing, or just wanting to understand where your money’s going, it’s important to know about the different types of mortgages.

After all, for most people, buying a home is one of the biggest financial decisions they’ll ever make.

And believe it or not, having this knowledge can potentially save you a lot of money in the long run.

So, are you ready to dive into the world of variable-rate mortgages?

I promise it’s not as scary as it sounds.

Let’s explore the three types of variable-rate mortgages together, shall we?

Standard Variable-Rate Mortgage (“Standard VRM”)

Imagine your mortgage payment as a pie. You need to deliver the same-sized pie each month, but how you slice it might change.

The slices represent your mortgage payment’s ‘interest’ and the ‘principal’ portions.

Now, when the lender’s prime rate changes, your standard variable interest rate changes too. However, even if the rate changes, the size of your pie (your total monthly payment) doesn’t change.

What does change is how big each slice is.

For instance, if the interest rate goes up, the ‘interest’ slice of your pie gets bigger, which means the ‘principal’ slice gets smaller.

This means you’re paying more toward interest and less toward the loan itself.

On the other hand, if the rate goes down, the ‘interest’ slice gets smaller, and the ‘principal’ slice gets bigger.

This means you’re paying less towards interest and more towards the loan.

The key takeaway is that your total monthly mortgage payment (the whole pie) usually stays the same with a standard variable rate.

What changes is how much of that payment goes towards the interest or the principal (the size of the pie slices).

Mortgage Payment Trigger Point

Now, there’s a special condition with your Standard VRM ‘pie’ we need to talk about, called the “trigger point.”

This point comes into play when more money is needed to cover both slices of your pie – the interest expense and the loan principal.

Think of it as trying to fit an extra slice into your already full pie.

If the lender’s prime rate keeps increasing, the ‘interest’ slice of your pie might get so big that your entire mortgage payment isn’t enough to cover it.

When that happens, you’re in a situation known as negative amortization, where not even a whole pie can cover the interest expense.

Here are some solutions your lender may offer you when your mortgage hits its trigger point:

- Raise your monthly mortgage payment to cover both the interest expense and loan principal.

- Make a lump sum payment to reduce the principal loan if extra funds are available. Most mortgages include prepayment privileges, allowing you to pay up to 15% of your original loan amount per year. This lump sum payment goes directly toward the principal.

- Switch to a fixed-rate mortgage. You can typically change from a variable-rate to a fixed-rate mortgage during the contract term. This switch can protect you from rising interest rates and prevent your mortgage from reaching the trigger point.

- Extend your amortization period to lower your regular payment. This option may not always be feasible unless you consider refinancing your mortgage.

Capped Variable-Rate Mortgage (“Capped VRM”)

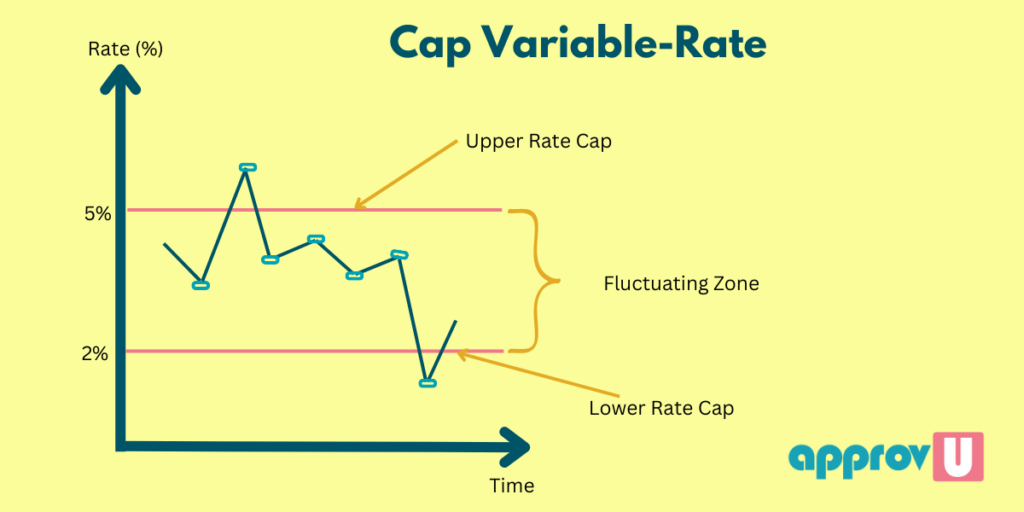

A Capped Variable-Rate Mortgage combines a standard variable interest rate with added protection against rate increases.

The “cap rate” sets a maximum limit on how high your variable interest rate can go.

In a Capped Variable Interest rate scenario, your rate is confined between an upper boundary of 5% and a lower boundary of 2%.

This means your rate will remain within these limits, irrespective of whether the market interest rate fluctuates above or below this predetermined range.

A capped Variable-rate is advantageous in a rising interest rate environment because your rate will decrease if the market rate drops and only increase up to the established upper limit if the market rate rises.

This type of variable-rate mortgage offers you a loan with a flexible interest rate but has a pre-set threshold.

This means that while the interest rate on your mortgage can change like in regular variable-rate mortgages, it won’t surpass a certain limit.

This mortgage option gives you financial security and peace of mind as you know your monthly payments won’t go above a specific amount.

Capped variable-rate mortgages provide greater predictability and easier financial management over time compared to standard variable-rate mortgages.

With this type of mortgage, you can enjoy potential interest rate decreases without worrying about unmanageable repayment amounts if rates unexpectedly soar beyond your capacity.

Your cap rate is set when you take out the mortgage. The payment for a cap rate mortgage is fixed, just like that of a standard variable rate mortgage.

Adjustable-Rate Mortgage (“ARM”)

An adjustable-rate mortgage, or ARM, is designed to allow the interest rate to adjust up or down over time based on changes in market conditions.

This means the regular mortgage payment for an ARM will increase or decrease as the market or interest rate changes.

For example, a rise in interest rates will trigger an increase in the regular mortgage payment to cover the increased interest cost.

This change in the mortgage payment ensures that the dollar amount allocated to pay the principal remains intact.

This means that the borrower will continue to pay off their mortgage at the same pace.

On the other hand, if the interest rate decreases, the regular mortgage payment will decrease as well.

This could be beneficial for the borrower as it could result in lower monthly payments and potentially reduce the overall cost of the loan.

It is important to note that the frequency and magnitude of interest rate changes can vary depending on the terms of the loan.

Before you choose an ARM, you should carefully consider the potential impact of interest rate changes on your monthly mortgage payment.

Additionally, it’s important to evaluate how these changes may affect your overall financial situation.

Overall, an ARM provides borrowers more flexibility in their mortgage payments and offers lower initial interest rates than fixed-rate mortgages.

However, borrowers should be aware of the potential for payment fluctuations and ensure that they can afford the maximum payment amount allowed under the terms of the loan.

Conclusion

To sum up, variable-rate mortgages can be an excellent choice for those seeking short-term financial benefits from lower interest rates or anticipating future income growth.

However, they have potential drawbacks and require careful consideration before signing up.

By understanding the various types of variable-rate mortgages, the associated risks, and other relevant factors, borrowers can make an informed decision that aligns with their financial goals.

Seeking the guidance of a financial advisor can help clarify whether this type of loan is the right fit for their individual circumstances.