Theodore Lowe, Ap #867-859 Sit Rd, Azusa New York

Theodore Lowe, Ap #867-859 Sit Rd, Azusa New York

Shop the best mortgage deals in Canada. approvU allows you to comparison-shop for the lowest rate mortgage deals across 25+ lenders and brands in Canada.

Mortgage Deals

Lenders & Brands

Huge Savings

See Your Personalized Mortgages Online With approvU

Ready to become a homeowner?

Fantastic!

This complete 10-step guide has everything you need for a smooth homebuying journey in Canada.

Buying a house is a big deal—it’s exciting but can also feel overwhelming. Before diving into listings and mortgage applications, let’s get you organized.

We’ll cover it all, from building your credit score to securing the best mortgage for your needs.

Before approaching a mortgage lender:

Getting a loan isn’t always a given. Lenders want to ensure you’ll pay them back, so they examine your credit history closely.

Your credit score matters – a lot. A great credit score shows you’re reliable and boosts your chances of getting a mortgage quickly. Here’s the type of information lenders focus on:

Want to improve your chances?

Focus on paying down those debts. Bad credit can make it harder to get a loan, or you might face higher interest rates.

Before getting attached to a house, it’s crucial to determine what you can afford.

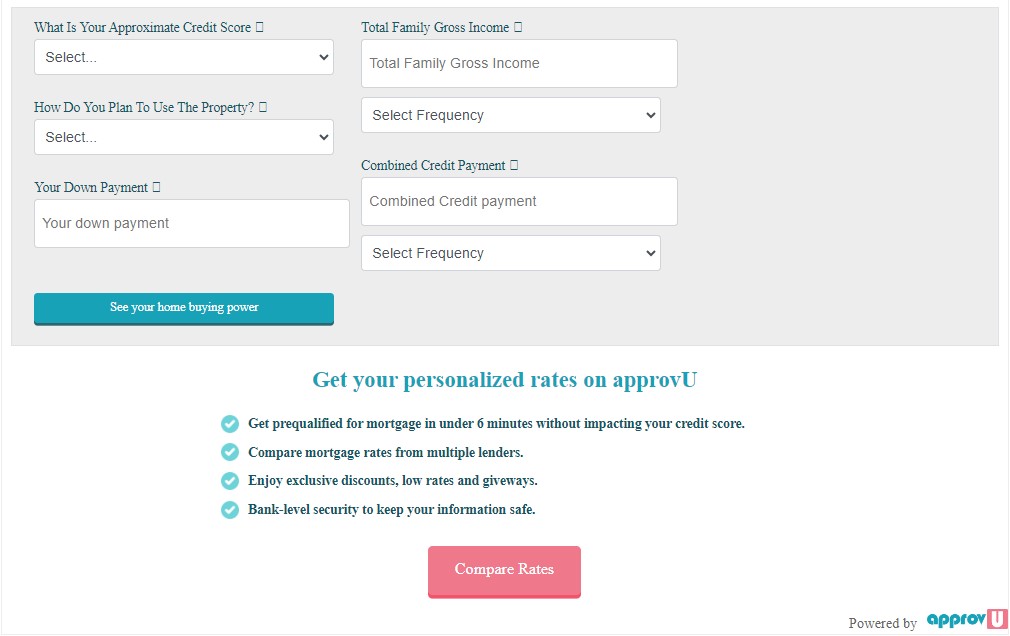

Use online calculators, like the approvU House Affordability Calculator, to input your financial details (income, debts, estimated down payment) and the home price range you qualify for.

Remember, while calculators provide a starting point, real life is more complex than numbers on a spreadsheet!

Here’s what else to think about:

Here’s what else to think about:

What’s Your Debt-to-Income Ratio (DTI)?

Think of DTI as a snapshot of your monthly debt compared to your income before taxes. Lenders use it to determine whether you can realistically afford another payment, like a mortgage.

How it’s calculated:

Why DTI matters:

Minimum Down Payments & Mortgage Insurance

Getting pre-approved is a smart move before diving headfirst into the house hunt. Here’s why:

A pre-approval gives you a realistic picture of how much mortgage you qualify for. This stops you from falling in love with a house you can’t afford.

One significant benefit of pre-approval is that it can give you an edge in negotiations. Sellers often view offers from pre-approved buyers more favourably, as it shows you’re not just browsing but ready to make a serious offer.

Another advantage of pre-approval is that it can streamline the final mortgage approval process. This can save you valuable time and alleviate some of the stress associated with closing the deal on your new home.

Note: A pre-approval isn’t a guarantee, but it’s a strong starting point!

Prequalification: A quick estimate. It’s based on the basic info you give the lender without them digging into your finances. This gives you a ballpark idea of what you qualify for.

Pre-approval: The real deal. The lender thoroughly checks income, debts, credit history to see if you qualify for a mortgage. They give you a specific amount for which you’ll likely get approved.

Pre-approval power: It’s good for 120 days and makes you a serious buyer in the seller’s eyes. You can still shop around for a better interest rate with other lenders!

A great agent is way more than someone who shows you houses. They’re your advisor, negotiator, and sometimes even a bit of a therapist during this big life change.

Taking the time to choose well is crucial!

See Your Personalized Mortgages Online With approvU

Now, the fun begins! But before diving in, take some time to get organized:

After figuring out your budget, the next big question is location. Here’s what to consider:

When touring a house, you aim to go beyond the listing photos and get a real sense of the place.

See Your Personalized Mortgages Online With approvU

Once you’ve found your desired house, it’s time to make an offer.

Your agent will guide you through this process.

First, they’ll help you craft a competitive offer that outlines the price you’re willing to pay, the amount of your deposit, your desired closing date, and any conditions you want to include (like a satisfactory home inspection).

Be prepared for some back and forth! The seller might respond with a counteroffer, changing the price or other terms.

You and your agent need to negotiate a few rounds before reaching a final agreement that works for both sides.

A home inspection is one of the most crucial steps in the buying process – it’s your chance to uncover hidden problems before you’re locked in.

Here’s how to make the most of it:

First, find the right inspector. Ask your agent for recommendations, or check with professional associations for certified inspectors in your area.

A good inspector will examine everything from the foundation to the roof, plumbing, electrical, and more.

They’ll provide a detailed report highlighting both minor issues and major red flags.

Pay close attention to this report! Even a seemingly perfect house might have expensive problems hidden (think mould or structural issues). The inspection can be your most powerful negotiation tool.

You might get the seller to lower the price to cover repairs, or you can add a condition to your offer to fix the problem before you close the deal. Sometimes, you might even walk away if the issues are too severe.

A home inspection is an investment that can save you thousands of unexpected costs.

Don’t skip this step!

Now’s the time to lock in that pre-approval! Start by choosing your lender.

Compare rates, terms, and the types of mortgages offered.

Do you want the predictability of a fixed-rate mortgage (where your payment stays the same), or are you comfortable with potential fluctuations in a variable-rate mortgage? An approvU mortgage expert can help you weigh the pros and cons.

Once you’ve picked your lender, it’s time for the formal application. This involves proof of income, employment, assets, and other financial details – the lender wants to ensure you can handle the payments.

Finally, the lender will order an appraisal. This is where an independent professional determines the fair market value of the house you want to buy.

The lender won’t give you a mortgage for more than the appraised value, so this protects both you and them.

Buying a house involves a lot of complex paperwork and legal jargon.

A real estate lawyer is there to protect your interests and ensure the whole process goes smoothly.

Start your search early—ask your agent for recommendations or check with your local law society for lawyers specializing in real estate.

Your lawyer’s job includes several key tasks.

A good lawyer can save you from costly mistakes and give you peace of mind during a potentially stressful time.

Don’t think of buying a house without protecting it!

Home insurance is a must to safeguard your investment against fire, theft, or unexpected damage.

Start by shopping around. Get quotes from several insurance companies and compare the coverage they offer.

Look at what’s included (and what’s not!), the deductible amount (the portion you pay out-of-pocket before insurance kicks in), and the monthly premiums (what you’ll pay for the policy).

Once you’ve chosen a policy, get it in place well before your closing date.

Why?

Because your mortgage lender won’t hand over the money for your house without proof that you’re insured.

Having this ready to go prevents any last-minute delays in the final steps of the buying process.

See Your Personalized Mortgages Online With approvU

Closing day is finally here!

This is when you officially become a homeowner.

But before you pop the champagne, there are a few essential steps:

Once everything is signed and the money moves, the keys are yours! Congratulations, you’re a homeowner!

Navigating through the 10 steps to house buying in Canada takes planning, patience, and the help of a great team (your agent, mortgage lender, and lawyer). By following these steps, you’ve turned the dream of homeownership into reality.

Remember, your house is more than just walls and a roof. It’s where you’ll make memories, build a life, and raise a family. It’s an investment in your future and a place to call your own.

Enjoy every moment of your homeownership journey!

Additional Tip: Even after you’re settled in, stay informed. From property tax changes to refinancing options, homeownership is always evolving. Keep learning to make the most of your investment for years to come.