Must-Know Mortgage Closing Costs for Canadian Homebuyers

Shop the best mortgage deals in Canada. approvU allows you to comparison-shop for the lowest

Theodore Lowe, Ap #867-859 Sit Rd, Azusa New York

Mortgage Deals

Lenders & Brands

Huge Savings

approvU allows you to comparison-shop mortgages offered by trusted lenders and brokers, making it possible to find the lowest mortgage rates in the market.

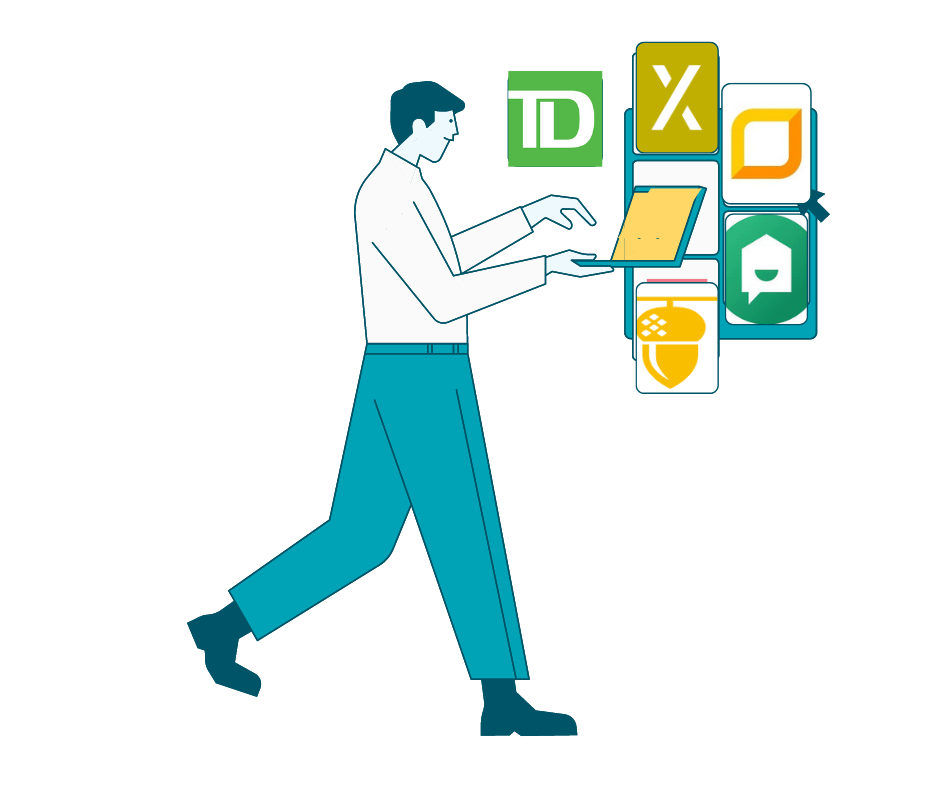

Access 1,000s of mortgages from some of Canada's top banks and discover low-rate mortgages in the market.

View the complete breakdown of your mortgage, rate, and closing costs. No baiting. No spamming.

Qualified mortgages are sure to best fit your unique situation and needs with a high probability of approval.

Here is how we make getting the right mortgage easy and convenient for you.

Provide approvU with a few details about your mortgage needs and financial and credit situations to customize your mortgage.

Select your preferred mortgages. approvU searches the market for the best deals you’re most likely to get approved for.

Upload the required documents and complete the conditions to get your loan funded in time.

Enjoy your home, knowing that you made the right mortgage choice without the outside influence of commission sales reps.

Receiving income from salary, wages, commissions, bonuses, tips and gratuities

Income to support your mortgage is from a business in which you own more than 25% interest.

Pension, disability, alimony, child support, tax credit, investment returns.

Credit scores above 620

Credit scores of 500 to 620

approvU provides a better way to search and apply for a mortgage from the comfort of your home, saving you from the stress and headache of the traditional mortgage process. You’ll want to take advantage of great deals from other lenders. approvU is your one-stop shop to search, apply, and get approved for your mortgage.

See Your Personalized Mortgages Online With approvU

Customize your mortgage with the basic information about your house ownership needs and wants, together with your credit and income situations.

Read More: Explore Basic Mortgage Features >>

View why your qualified mortgages are best for you, and the factors that went into determining your mortgage rate.

Save time, save money, and boost your approval power with easy multi-lender application submissions, to guarantee multiple approvals.

Read More: Explore Lenders you can Access on approvU >>

Even experienced homeowners still need help and support to make the right mortgage decision. approvU’s team of licensed Mortgage Experts is ready to answer all of your questions about getting the right mortgage using approvU, or merely discussing the market.

If you have decided to buy a house and have a high enough credit score and the necessary down payment, you can start by getting pre-approved for a mortgage.

Mortgage pre-approval is an acknowledgment that you could qualify for the mortgage amount based on the information you provided. Note that mortgage pre-approval is not a guarantee for mortgage approval. Also, mortgage pre-approval is not a required step, but an essential one.

You can certainly skip the mortgage pre-approval step and go shopping for a house.

Either way, the right time to apply for a mortgage is when you have an accepted and signed offer. To proceed with the mortgage review, the lender needs complete information about the property and accepted price.

approvU offers varied types of mortgages – from standard fixed-rate and variable-rate mortgages, to specialty mortgage programs like bad credit mortgages.

You can use approvU to get mortgages to buy your house even if you are a:

– First-time homebuyer

– Bad credit borrower

– Self-employed borrower

approvU also offers mortgage refinance programs like:

– Cash-out refinance

– Debt consolidation refinance mortgages

– Equity takeout refinance mortgage

No, approvU is not a mortgage lender.

approvU is an online distributor of mortgages. We do not replace mortgage lenders. We make it easy for you to shop and get the right mortgage easily and conveniently. approvU allows you to shop for mortgages across multiple lenders, so you won’t miss out on the lowest mortgage rate.

Yes, approvU makes applying for a mortgage with bad credit easy and convenient. You can search and apply for a mortgage online with approvU, like booking your favourite vacation on Booking.com or buying on Amazon.ca.

approvU instantly qualifies you against the criteria of over 25 lenders, ensuring you get the best deal in the market.

Yes, approvU makes the process of applying for a mortgage if you’re a self-employed borrower easy, like booking your favourite vacation on Booking.com or buying on Amazon.ca.

approvU instantly qualifies you against the criteria of over 25 lenders, ensuring you get the best deal in the market.

The process of signing up with approvU

See Your Personalized Mortgages Online With approvU

Shop the best mortgage deals in Canada. approvU allows you to comparison-shop for the lowest

Shop the best mortgage deals in Canada. approvU allows you to comparison-shop for the lowest

Shop the best mortgage deals in Canada. approvU allows you to comparison-shop for the lowest

It can be challenging to buy a house with bad credit, but not impossible. We

Shop the best mortgage deals in Canada. approvU allows you to comparison-shop for the lowest