Bad credit can be a barrier to entry to all sorts of things. It can make it harder to buy a car, buy property, and secure any loan with favourable rates.

If you’re finding it hard to make the financial moves you want because of your credit score, it’s probably a good idea to start improving it.

But if you think you can adjust your financial habits and see your credit score go through the roof overnight, think again.

The road to better credit can be long, so get started as soon as possible is best.

Your starting point will significantly affect how long it takes to improve your credit score.

With the correct information and guidance, you will realize that the road to an excellent credit score is relatively straightforward.

What Factors Make Up Your Credit Score?

Before you look for ways to improve your credit score, it’s essential to understand what factors affect it in the first place.

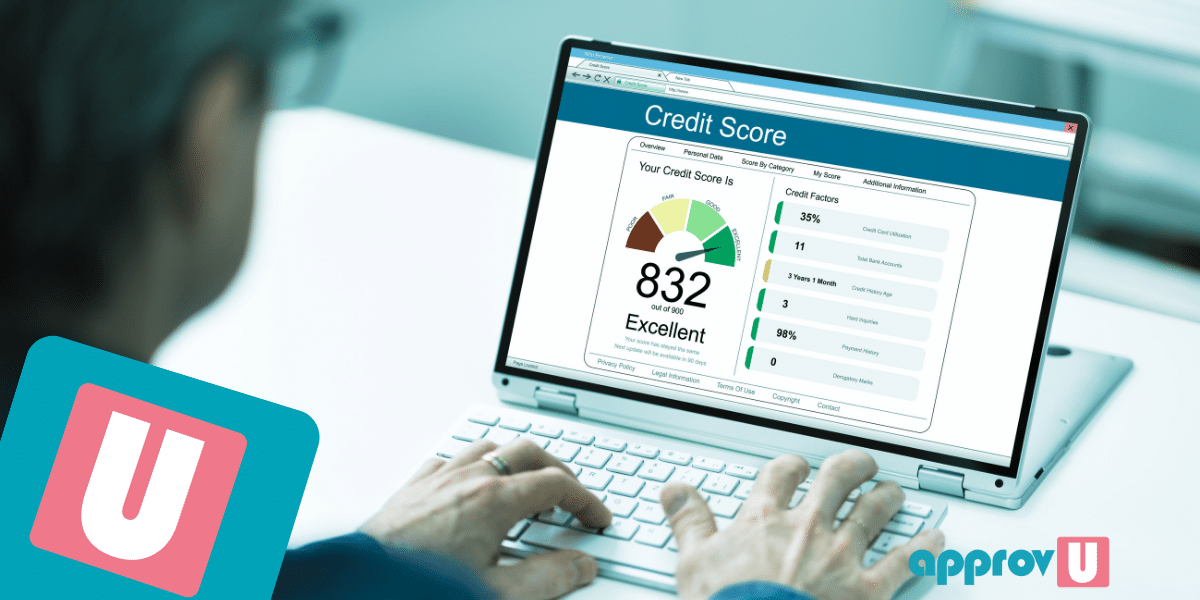

Your credit score falls on a scale between 300 and 900 in Canada.

This score is made up of the following factors:

- Payment History (35%): This shows how well you’ve done in the past with paying bills and loan payments on time.

- Credit Utilization (30%): This shows the amount of available credit you currently use. So, if your only credit account is a credit card with a $1,000 limit and you’ve used up $100 of your limit, your credit utilization rate is 10%. You’ll generally want this to be under 30%.

- Credit History (15%): This shows how old your credit accounts are. Generally speaking, the older your bills, the better (assuming you’ve kept them in good standing).

- Inquiries (10%): This shows how often you apply for a new credit account. Multiple inquiries in a short period can be a warning sign to lenders.

- Credit Diversity (10%): This shows your mix of credit accounts—the more types of accounts you have, the better.

The 4 Ways to Improve Your Credit Score

Once you understand what factors make up your credit score, it’s a relatively straight line to determine what you can do to help improve it. Let’s take a look at some of these.

Pay Your Bills on Time

The first thing you might have noticed in the last section is how important it is to pay your bills on time.

So, it makes sense that our number one tip to improve your credit score is to make sure you keep up with your loan and bill payments.

Setting up automatic withdrawals from your bank account to make payments for these debts is advisable. This will help you pay your bills on time as they come due.

Remember, not all utility or telecom companies report payments to credit bureaus, so making on-time payments may not always affect your credit score.

Dispute Any Errors on Your Credit Report

Everyone makes mistakes, and that includes credit bureaus. That’s why you must get a copy of your credit report and review it with a fine-tooth comb.

No one would blame you for assuming that the information on your report is accurate, but this could mean that your credit has gotten dinged through no fault.

You can get your report from Equifax or TransUnion.

There could be a few different types of errors that you might run into, but you should keep an eye out for the following:

- Wrong personal information

- Wrong information on your public records

- Any accounts that you haven’t opened but are listed in your name

If you spot any errors, you should file a formal dispute with a credit bureau to get these off your report.

And if there are any accounts in your name that you haven’t opened, contact those providers to let them know immediately.

This could be a sign of identity theft.

Get a Secured Credit Card

If your bad credit score has made it challenging to get approved for a credit card from a provider, you can still likely get a secured credit card.

You can use these for the same things as a regular credit card, like online shopping, renting a vehicle, and more.

The main difference is that instead of being approved for a credit limit, you’ll have to give the provider money ahead of time to secure your account.

The amount you give them will essentially serve as that card’s credit limit.

Using this card can improve your credit score by making timely payments and keeping your account in good standing.

Pay Off Your Debt

As we saw earlier, your credit utilization can significantly impact your credit score.

That means that if you have a lot of debt on your plate or use up a large chunk of the total amount of credit available through your credit cards or lines of credit, this could hurt your credit score.

If that’s the case, make a concerted effort to pay off what you owe to lower your credit utilization rate.

Use These Tips to Improve Your Credit Score

A lot goes into your credit score; giving it a boost won’t be a walk in the park.

While it’s a long road, it’ll be worth the wait.

Not only is it helpful to implement better financial habits into your life, but an improved score will also mean more borrowing options will become available.

We hope these tips can help you on your journey to improve your credit score!