Theodore Lowe, Ap #867-859 Sit Rd, Azusa New York

Theodore Lowe, Ap #867-859 Sit Rd, Azusa New York

Shop the best bad credit mortgages in Newfoundland & Labrador. approvU allows you to comparison-shop low-rate mortgage deals across 25+ lenders and brands in Canada.

Mortgage Deals

Lenders & Brands

Huge Savings

Finding the right mortgage for your Newfoundland & Labrador homeownership journey is crucial, but what if your credit score isn’t perfect?

Let’s face it: bad credit can create hurdles to homeownership.

But don’t despair!

This guide explores bad credit mortgages as a potential solution for aspiring Newfoundland & Labrador homeowners like you.

These specialized mortgages can help you bridge the gap between your credit situation and the dream of owning a home in Newfoundland & Labrador.

While a bad credit score might limit your options with traditional lenders, bad credit mortgages offer a lifeline, allowing you to enter the housing market and build a brighter financial future.

In the following sections, we’ll delve into the specifics of bad credit mortgages in Newfoundland & Labrador.

We’ll explore how they work, highlight their potential benefits, and guide you through the crucial considerations before embarking on this path.

With careful planning and guidance, you can transform the dream of owning a home in Newfoundland & Labrador into a reality, even with credit challenges.

Best bad credit mortgages from top alternative lenders offering mortgages in Newfoundland & Labrador. Rates are updated daily. Select a mortgage to view more details.

approvU allows you to instantly shop the market for the lowest mortgage rates in 3-easy steps

Provide approvU with a few details about your mortgage needs, including your financial and credit situations.

approvU searches through over 11,000 mortgages and matches you with those you are most likely to get approved.

Make your mortgage selections; complete and submit your application directly to lenders for final approval.

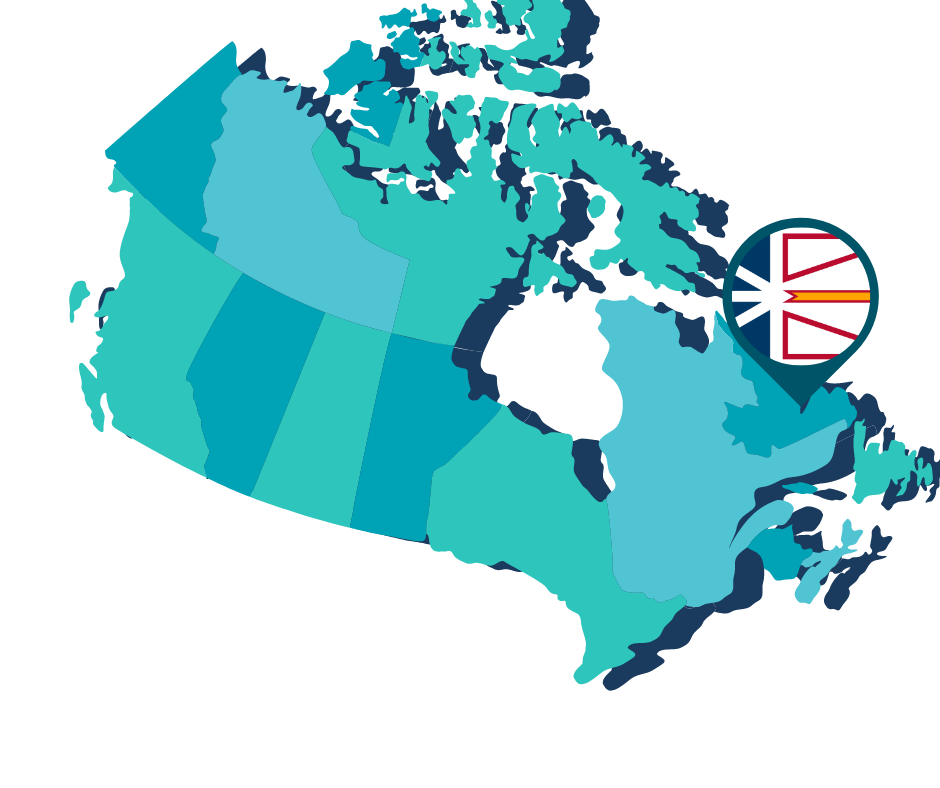

Newfoundland and Labrador merge the charm of the old world with the conveniences of the new, boasting a lively culture and pioneering industries. This province offers a unique mix of urban sophistication and serene rural living, with smaller cities than those in Ontario, Quebec, BC, and Alberta, fostering a laid-back lifestyle.

Despite its vast land size, surpassing countries like New Zealand and Japan, it has a cozy population of just 522,875. The housing market here is more stable than in many other Canadian provinces, with an average home price of $208,388 as of August 2022, per CREA’s statistics, making it an appealing choice for those seeking affordability and quality of life.

$281,600

$221,593

522,875

$82,540

See Your Personalized Mortgages Online With approvU

So, what exactly are bad credit mortgages in Newfoundland & Labrador, and how do they differ from traditional options?

Generally, a bad credit score in Canada falls below 600. This can be due to missed payments, high credit utilization, or limited credit history.

With a bad credit score, traditional lenders in Newfoundland & Labrador might be hesitant to offer you a mortgage, or if they do, the interest rates could be significantly higher.

Bad credit mortgages cater to individuals with less-than-perfect credit scores.

These specialized mortgages are offered by lenders in Newfoundland & Labrador.

They understand that credit situations can improve over time and are willing to work with borrowers who might not qualify for traditional options.

There are two main categories:

While bad credit mortgages come with some drawbacks (which we’ll discuss later), there are also undeniable benefits to consider.

If you’re a Newfoundland & Labrador resident with less-than-perfect credit and a dream of homeownership, these advantages can be significant.

While bad credit mortgages offer a path to homeownership in Newfoundland & Labrador, it’s vital to understand the potential drawbacks before taking the plunge:

With a firm grasp of both the benefits and drawbacks of bad credit mortgages in Newfoundland & Labrador, it’s time to explore how to find the best option for your needs.

Here’s your roadmap to navigating the landscape:

Bad credit can make the road to homeownership in Newfoundland and Labrador more challenging, but it isn’t impossible.

Bad credit mortgages offer a lifeline, allowing you to enter the housing market and build a brighter financial future despite credit challenges.

Remember, the key is approaching this path with careful planning and a realistic understanding of the financial commitment involved.

Weigh the benefits, like becoming a homeowner and potentially improving your credit score, against the drawbacks, such as higher interest rates and shorter amortization periods.

Don’t be afraid to seek professional guidance from qualified mortgage brokers or credit counsellors in Newfoundland & Labrador.

Their expertise can be invaluable in navigating the complexities of bad credit mortgages, securing the most favourable terms, and ensuring you make informed decisions.

With careful planning, responsible budgeting, and the proper guidance, you can transform the dream of owning a home in Newfoundland & Labrador into a reality, even with bad credit.

Now, you’re empowered to take the first step.

Start your research, explore your options, and move confidently towards achieving your Newfoundland & Labrador homeownership goals.

See Your Personalized Mortgages Online With approvU